The RR Auction House from Boston announced the sale of a lunar meteorite for $612,500. The Moon rock that weighs 12 pounds (5.5 kilograms) was found last year in Mauritania, northwest Africa.

The specimen was sold by the company Aerolite Meteorites, and the winning bid came from a representative of the Vietnamese complex Tam Chuc Pagoda.

The former owners announced on their Twitter account that the rare rock will go to a:

“worthy home to be cherished and curated.”

Our Rare & Remarkable lunar meteorite sold last night for over $600k and is going to a worthy home to be cherished & curated—we are over the moon! https://t.co/VInvdYeAJ0 @MeteoritesAZ @geoffnotkin @AP #Space @collectSPACE #moon @MeteoriteMen pic.twitter.com/5BoQgrol38

— RR Auction (@RRAuction) October 19, 2018

The Lunar Puzzle

The $600,000 rock’s official name is NWA 11789. Since it’s composed of six fragments that are assembled together, the meteorite is also called “The Lunar Puzzle” or “The Moon Puzzle.”

It’s one of the largest lunar meteorites found on Earth and the largest ever sold at auction. Moreover, its size isn’t its only special characteristic. The rock has a “partial fusion crust,” the result of the heat that makes the rock burn when entering the Earth’s atmosphere.

Pieces of the Moon aren’t common collection items. Even if astronauts have brought back samples from their lunar missions, these belong to the Government, so buying lunar meteorites is difficult.

Geoff Notkin, CEO of Aerolite Meteorites, for Reuters said:

“Meteorites themselves are rare. In all of history, there’ve been approximately 60,000 different meteorites found and recorded by science. Less than 350 of them are lunar meteorites.”

Thanks to the meteorite’s rare appearance, the RR Auction House had predicted that the Moon Puzzle would get $500,000 at auction. Experts believe that the lunar meteorite landed on Earth thousands of years ago.

The Most Expensive Meteorite Is Worth Almost $2 million

The Moon Puzzle has become one of the most expensive meteorites ever sold, but it’s still far from the costliest rock to fall on Earth. The most expensive meteorite is valued at $2 million.

It’s the largest portion of the Fukang meteorite which weights 925lb (around 420 kilograms). The anonymous collector who owns it tried to sell it at auction, but the piece remains unsold.

Smaller pieces of this type of meteorite sell for $25-38 per gram. The Fukang meteorite could be older than our planet and has unknown origins.

It belongs to the pallasite class, which makes up just 1% of all meteorites. Pallasites are thought to be the remains of forming planets, being made of nickel-iron and olivine, which gives them a mosaic-like appearance.

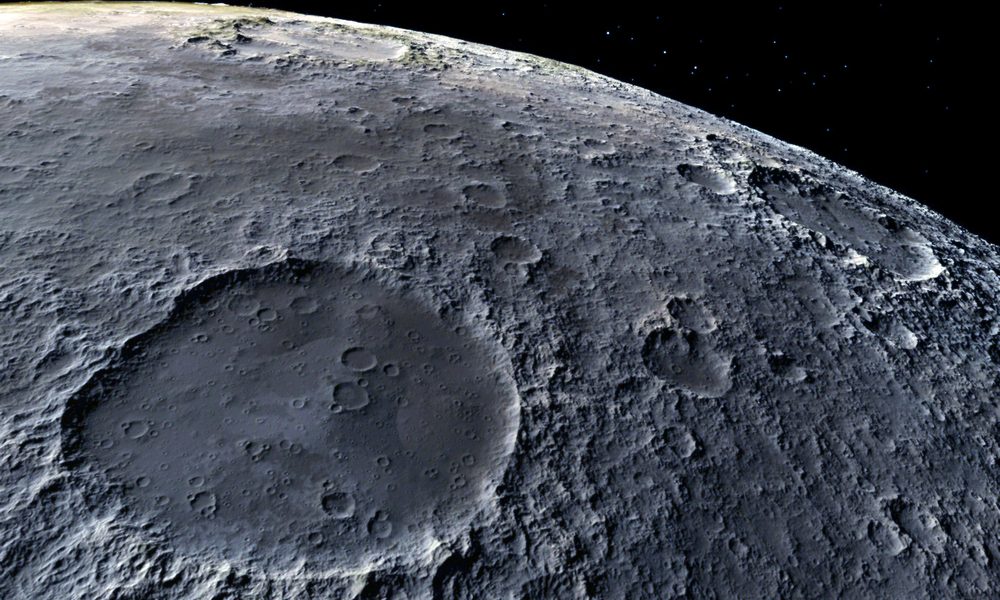

Featured image from Shutterstock.